Imagine you ran an online shop for fashion products and have recently generated an additional marketing budget of 20.000 Euro. Now you would like to use this budget to exploit new online channels. How do you proceed?

The testing phase

Just the other day, you heard about fashion blog A and fashion blog B being highly adequate as advertising platforms for your product segment. For blogs are not part of your channel portfolio so far, you decide to invest your additional marketing budget of 20.000 Euro in equal shares into A and B as a test – to finally choose one of them for integration into your standard channel portfolio on the basis of their measured performance

No sooner said than done: 10.000 Euro go to channel A, 10.000 Euro go to channel B. Turn on the webanalytics, lie back, await events.

Measure performances

One month later. You check your webanalytics and see the following information:

|

| Performance of online channels tracked with web analytics: conversion rate, revenue. |

Bingo! The results are clear – in future, you will invest the budget of 20.000 Euro into blog A completely.

Having made this decision, it’s time for lunch: You got an appointment with an old friend who works in the IT department of an online shop for sports shoes by now. Gladly, you tell him about your smart move in managing your online channels – and gain admonishing words:

Watch out! Webanalytics are not enough!

Your friend knows what he is talking about – in cooperation with a BI service provider, he implemented a Business Intelligence solution for his own shop just recently. Even now, experiences indicate: Only by integrating online and offline data (concretely: webanalytics and commodities management), you can effectively handle margin killers like returns and high costs of sales that critically affect contribution margins. In webanalytics sytems, these metrics stay invisible. What’s the use of a high gross revenue (before returns), if it is ruined by numerous (and expensive!) returns for the most part, corresponding a low or even negative contribution margin?

Finally doing it the right way: integrate a BI solution

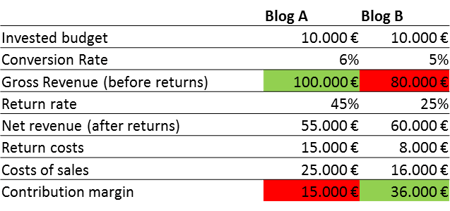

To get to the bottom of things and gain insights in your data quickly, you register online for a demo of an eCommerce SaaS BI solution on your own data. The information being displayed now, on the basis of holistically generated metrics, is astounding:

|

|

Performance of online channels tracked with Business Intelligence: returns, costs of sales, contribution margins.

|

A 21.000 Euro discrepancy between the resulting contribution margins – in favor of channel B! Investing the budget in channel A completely seems quite absurd by now. Instead, the 20.000 Euro marketing budget will go to channel B entirely from now on and thus lead to far higher profits.

Conclusion

Online and offline processes intertwine permanently in online retailing. To adjust budgets efficiently, a holistic view on the relevant metrics therefore is indispensable: online data from the webanalytics have to be integrated with offline data from the commodities management and thus be analyzable holistically. Otherwise, contribution margins per online marketing or distribution channel cannot be calculated – disastrous in case of hidden margin killers like for example high return rates. Without a BI solution, on the pure basis of webanalytics data, big budgets are burnt for avertible returns all too quickly.

FACTS & FIGURES:

- Online shops record up to 60% losses in sales caused by returns (research: Trusted Shops)

- 55% of online shops do not work with return probabilities (research: ibi research)

- 32% saving of costs, if badly performing channels and campaigns are cut off in time (research: nextel BI Solutions)

nach Wunsch auch mit Videocall

nach Wunsch auch mit Videocall