Customers are becoming more and more demanding every day – not only with their expectations for a consistent brand experience, but also with the buying process itself. Also, for accompanying communication, today's customers have high expectations of the way that they want to be addressed by brands and sellers. As individual as the dress sizes or tastes of the customers are, so too are their expectations of being addressed. In order to be successful in the modern retail age, a new law applies: the right message for the right customer – whoever wants to be a first-class seller needs to have first-class customer segmentation.

The calculation is actually quite simple: if customers do not get the right message, the right offer, or the appropriate incentive at the right time, they will most likely not buy. However, even if this problem seems to be so simply and clearly defined – and actually known for a long time – there has never been a system that allows a simple, as well as flexible, customer segmentation based on all relevant data points. With the minubo customer segmentation, this changes. But before we go into it in more detail, let's take a look at three classic segmentation scenarios.

Example 1: Churn Prevention

Identify and reactivate valuable customers - before they jump off

The maintenance of existing customers is significantly cheaper than new customer acquisition. Keeping these customers and making sure that they do not jump off nor move to the competition is thus of central importance.

In order to ensure this, each customer segment should always be monitored to see which customers have not bought for an average period (e.g. number of days since the last order > average inter-purchase time plus X). Regular reactivation measures should be implemented for this segment to keep it as small as possible – for example, by allocating vouchers, offers according to preferred product category or specific cross-selling strategies.

Investing in such reactivation measures is particularly useful for those customers who have a high value for the brand or seller – in the truest sense of the word. Depending on the commerce organization, this value can be measured using different key figures (e.g. their turnover volume, their coverage contribution rate, the frequency of their orders, the amount of their basket value or their return rate).

Example 2: Loyalty Programs

Do not let the most loyal customers slip off the radar

A loyal customer base is particularly valuable for a commerce organization because they have high purchasing potential and are a constant basis for sales, which enables stable company growth.

So there is no question that you should never lose sight of your most loyal customers and provide them with personalized offers at the right moment – for example with exclusive product novelties, personalized vouchers or special discounts. This involves knowing and observing the most loyal customers of a segment (e.g. frequency of order, days since last order, gross order value, or contribution margin).

Customers in this top segment are also worth the extra effort to take a closer look at their product preferences, in order to enable an even more personal approach. If, for example, the superior customer segment is subdivided into preferred product categories, an even more targeted approach can be implemented in a simple manner.

But changes in the most loyal customers segment – whether in terms of size, turnover or return behavior – must also be observed. These changes can be indicative of changes in the customer base, which must be investigated in case of doubt. If, for example, declining revenue in the segment is recognizable, the mode of communication must be considered and, if necessary, adjusted in order to encourage loyal customers to buy more.

Example 3: First-Time Purchasing

Re-engage first-time buyers with customized offers

Gaining new customers is of paramount importance in the retail industry. In order to make the cost and effort required for this work worthwhile, it is important to encourage the newly acquired customers as soon as possible to re-engage and to establish a relationship between them and the brand.

Time is a decisive factor here. Addressing the first-time buyer should not only include initial communication about the first purchase of the new customer. Rather, a medium-term communication strategy over the following weeks and months is the key to success. A simple "welcome" e-mail, a nicely formulated order confirmation or the sending of a coupon code the day after the purchase are, by far, not enough to hold a first-time buyer

Instead a regualar communication plan needs to be set up with a focus in content on the first purchase category. Thereby correct time intervals of addresses are of great importance. Data from the customer base related to the average time between initial purchase and second purchase can be an initial reference point when determining the composition of the appropriate communication intervals. The content of this communication strategy must include appropriate offers and purchase recommendations with reference to the first purchase category to re-engage the first-time buyers.

The innovative minubo customer segmentation

This all sounds plausible and several systems spontaneously come to your mind that can realize such a customer segmentation? Then let us think a step further.

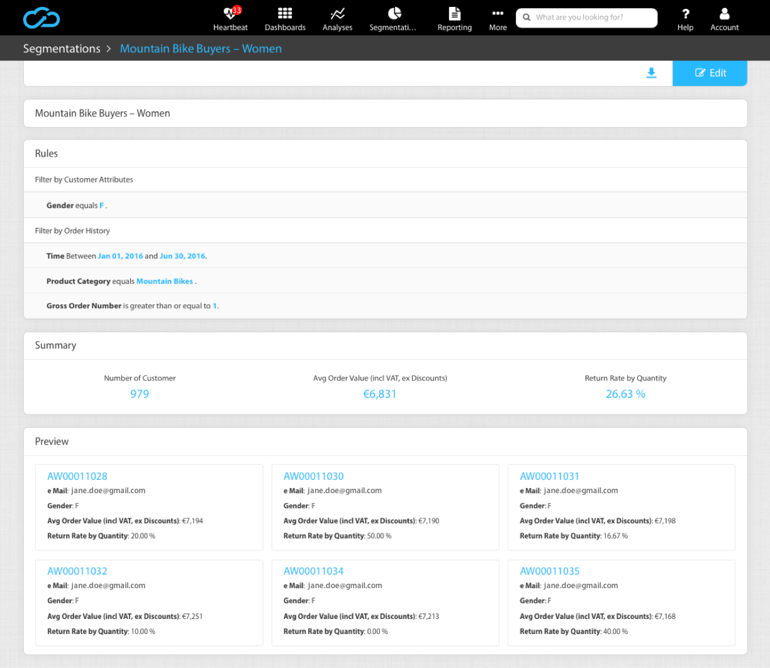

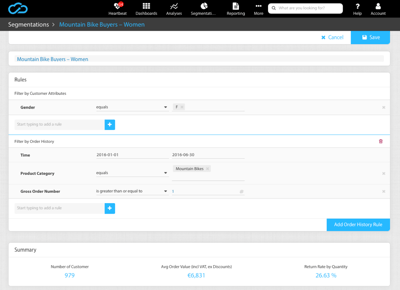

Imagine the following: You would like to know how many customers bought at least one specific product (or products from a particular product category) between 01rst of January and the 30th of June and spent more than € 50. These customers should also have a return rate of less than 20% over their entire customer lifecycle. In addition, these customers should be over 25 years of age and live in Germany or Austria.

How do you find that? Segmentation solutions offered so far do not allow the user to define complex customer segments. In most cases, you have to work with predefined segments, which are usually too inaccurate and inflexible with regard to your own business model. Moreover, e.g. email marketing tools for segmenting use exclusively demographic data (gender, age, country, etc.) as well as e-mail performance data (average opening rates, click rates, time of the last email, etc.). Data relating to the customer's purchasing behavior (e.g. number of orders, return quotas, acquisition channel, or purchased products) are not included in the segmentation.

The new, and flexible, customer segmentation of minubo is based on a much more comprehensive data set. The underlying minubo Commerce Intelligence Suite is not only a front-end, but also a data warehouse. It links all the data available in the commerce organization to a comprehensive Omni-Channel database - data from the order management system, from the eCommerce platform, from the webtracking tool, as well as cash and branch data are included. With this base of data you get a much more comprehensive and accurate customer segmentation.

The new, and flexible, customer segmentation of minubo is based on a much more comprehensive data set. The underlying minubo Commerce Intelligence Suite is not only a front-end, but also a data warehouse. It links all the data available in the commerce organization to a comprehensive Omni-Channel database - data from the order management system, from the eCommerce platform, from the webtracking tool, as well as cash and branch data are included. With this base of data you get a much more comprehensive and accurate customer segmentation.

The minubo customer segmentation opens up completely new possibilities for CRM and marketing teams. For the first time, customers can be segmented quickly and easily across all relevant data points. Demographics, transactions and journeys – customer attributes (e.g. age, gender or location) and data from the purchase history (e.g. product category, period of the last order or gross order quantity) can be linked to each other so that flexible, individual segmentation can be carried out, which meets the specific requirements of any commerce organization. In addition, these segments can be directly integrated into e-mail and campaign management tools to make it easier for each customer to interact with matched, relevant content.

What does this mean for the question from our mental game? With the minubo customer segmentation it is easy to answer!

Would you like to learn more about the minubo customer segmentation? In our release-paper, you will find all the important information at a glance.

You want to stay uptodate about the lates blog post or upcoming webinars? And you don't want to miss what's new with the minubo Analytics Cloud? That is no problem at all:

nach Wunsch auch mit Videocall

nach Wunsch auch mit Videocall