New customers are costly, existing customers are cheap – nowadays, these basics of eCommerce can be recited by any online retailer by heart. And even if, obviously, this kind of generalization is extremely dangerous (through complex customer retention methods, existing customers can get quite costly as well, whereas new customers can often be gained by affordable, wide-coverage acquisition methods), it still contains a fair bit of truth: existing customers (usually!) not only can be motivated to repurchase less costly, moreover they ensure profits – in the long-term.

Therefore, a main goal every marketing and CRM manager tries to achieve is the following: New customers shall be converted into existing customers and be bound to my company long-term!

1) Ask the right questions: How are my customers behaving after the initial purchase?

To take the goal into action and convert costly new customers into affordable existing customers, you absolutely need to evaluate your customers’ repurchase behavior and the underlying marketing strategies. The key question to success: How are my new customers behaving after their initial purchase?

Case 1: A new customer purchases once again

What kind of customers are coming back for a second purchase?

What kind of customers are coming back for a second purchase?

Goal of analysis: identify common attributes

Insight (e. g.): 80% of rebuyers are of age 18 to 30, whereas only 50% of my new customers belong to that group of age.

Action: Already in acquiring new customers, you can focus on the regarding customer group – that is where more profits can be gained long-term.

When do my customers purchase a second time?

Goal of analysis: Determine ø time to second purchase

Insight (e. g.): My rebuyers averagely repurchase after 6 weeks.

Action: Actions for reactivation should be adapted to the determined period of time purposefully (e. g. newsletter dispatch) – that increases your chances of success per customer and your repurchase rate in general.

Which marketing channel wins my customers back?

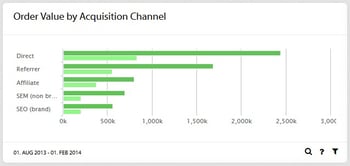

Goal of analysis: Compare channels of acquisition regarding first and following orders

Insight (e. g.): While I regain 35% of my SEA initial buyers (who become rebuyers) via display campaigns, it is only 6% among my price comparison initial buyers – their reactivation is more successful via my newsletter (25%).

Action: Customers should be segmented by acquisition marketing channel and each group should be provided with corresponding measures of reactivation. In the course of this, customers from costly marketing channels should be transferred to more cost-efficient channels (goal-channel: direct).

Via which distribution channel do I win back which kind of customer?

Goal of analysis: Compare distribution channels of initial and second purchase

Insight (e. g.): 90% of my amazon initial buyers purchase via amazon again, when they place their second order.

Action: In order to improve the positioning of your own shop versus the expensive marketplace and in order to strengthen the customer’s brand consciousness for your company, you could convert amazon buyers into shop buyers by sending them customized newsletters with special offers only valid for your webshop.

What kind of product is motivating my new customers to make a second purchase?

Goal of analysis: Identify patterns of product choice (initial purchase/following purchases)

Insight (e. g.): 60% of my initial buyers who bought shoes order shoes in their second purchase again, whereas 50% of my jeans initial buyers purchase jumpers and accessories when buying a second time and 80% of sportswear initial buyers purchase different kinds of sportswear of the same category when buying a second time.

Action: In future reactivation campaigns targeting at different customer groups, you can promote products with optimized purchase probability for each segment of initial buyers more target-aimed.

Case 2: A customer is lost after his initial order

Fault analyses are an important instrument to identify possible patterns of failure and avoid them in the future. Maybe, lost customers have common characteristics? Perhaps there are any similarities concerning the applied (and failed) reactivation methods? Or is the problem already lying in the first acquisition? Are there specific groups of new customers whose repurchase rate is stunningly low? In that case, you could cut off some costly acquisition campaigns and thus raise your margin.

2) Method of choice: Cohort analysis – by time, by channel, by product

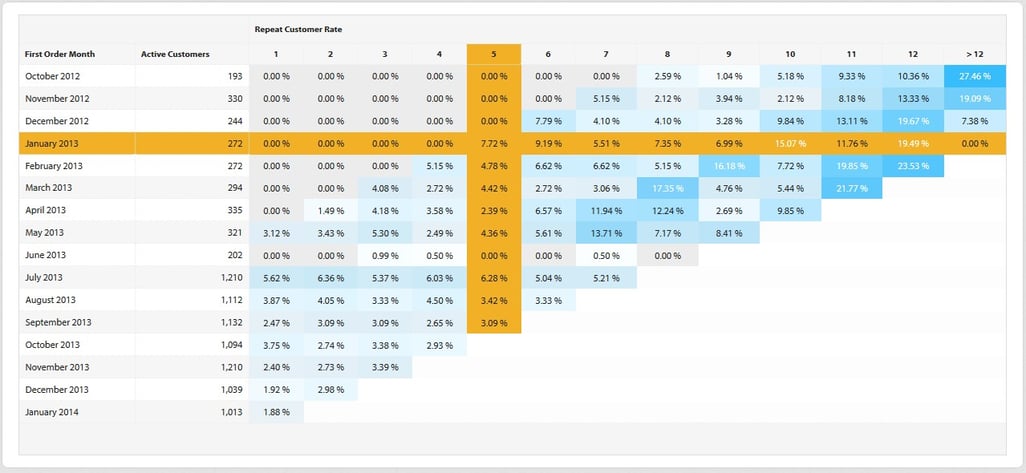

The best questions are useless, if no means are available to find any answers. The most appropriate way of answering the questions given above are cohort analyses: In cohort analyses, customers are segmented by some initial buy criteria (period of time, channel of acquisition, purchased product…) and their repurchase behavior (time of rebuy, channel of reactivation, rebought products…) is displayed over the following months.

In the minubo web-frontend for instance, the Detail Report of a cohort analysis regarding repeat customers (x% of new customers originating from month y buy once again z months later) looks like this:

If you identify significant variations in that aggregated view, the analysis can be refined in the minubo excel frontend: What kind of customers are behind a noticeably high repurchase rate? What kind of marketing activities did work out well? (How such a scenario can look like, you can find out in one of our use cases: “Create long-term customer loyalty: customer marketing via cohort analysis”.)

Complemented by further cohort analyses (e. g. regarding channels of acquisition or purchased products), this is an efficient way to get the full picture of your customers’ repurchase behavior. You can define the right marketing mix for each of your customers and increase repurchase rates purposefully by using the questions given above. For a strengthened base of existing customers that ensures your lon-term profits!

If you'd like to ensure successful customer retention in your online shop as well, minubo could be useful for you: All of the introduced reports are available in our solution at the click of a mouse. If you'd like to learn more, just register for one of our product tour webinars:

nach Wunsch auch mit Videocall

nach Wunsch auch mit Videocall